Crown Street, Wollongong, 2500

How Businesses Can Avoid Crazy International Transaction Fees

Credit card companies typically charge international transaction fees whenever you pay for something in a foreign currency. While these fees are most commonly associated with travellers, businesses may also incur foreign transaction fees when they make online and overseas purchases or when they are making foreign transactions.

When using your credit card to pay for something located outside of Australia, it is common to encounter foreign transaction fees that may range from 2-4% of your total transaction amount in Australian dollars. But in general, this type of credit card fee, imposed by your credit card issuer, typically takes up around 3% of the purchase amount. This means that if you are paying $1,000 overseas and have a credit card that charges a 3% foreign transaction fee, the additional cost would be $30.

As a marketing agency, our team extensively relies on various tools and has a lot of automation in place, all requiring subscriptions. It wasn't until the onset of Covid-19 and lockdowns that I became aware of the pesky foreign transaction fees we were incurring due to our busy operations.

This needed to change so I took the time to find a solution. I initially called my bank, exploring the possibility of paying a higher annual fee in exchange for waiving any international transaction fee. However, I was informed that, as a business owner in Australia, they cannot offer any solutions to eliminate these fees.

I was taken aback by this response, leading me to reach out to multiple other banks. After numerous enquiries, it became apparent that, as a business, there was no available banking solution, whether through debit or credit cards, that could provide relief from all these foreign transaction fees. Luckily, I was able to discover a solution on how to avoid international transaction fees that are neither expensive, slow, nor complicated.

The Solution to No International Transaction Fees for a Business

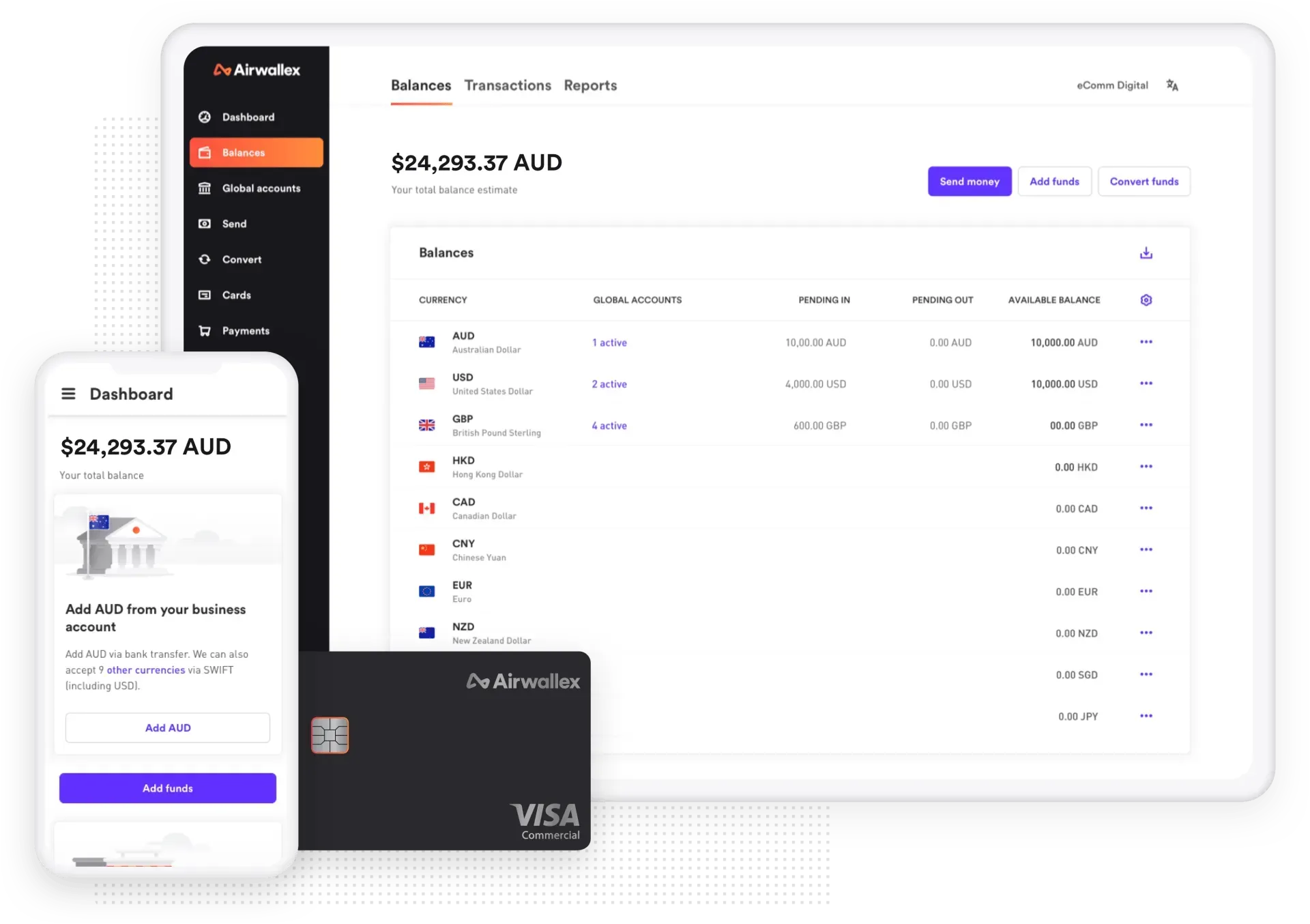

A number of clients with overseas expenses and customers are losing up to 5% in profits to hidden currency conversion fees. With Airwallex, businesses can have a better and more cost-effective way to manage money globally.

Airwallex is a global financial technology company that offers integrated solutions for cross-border payments, foreign exchange, and international collections for businesses. It was founded in 2015 with the goal of removing the complexity and costs associated with international transactions.

Airwallex allows businesses of all sizes to manage their international financial activities easily and efficiently. With its user-friendly platform and competitive pricing, Airwallex is quickly gaining popularity as a preferred provider for businesses with global payment needs.

Why should you use Airwallex?

Airwallex is designed to take the hassle out of international payments and collections. With its real-time tracking of global currencies, Airwallex is a reliable and secure solution that offers businesses multiple options for transferring money across borders. Unlike legacy core banking systems that are often slow and unreliable, Airwallex enables your business to operate seamlessly across borders while ensuring speed, ease, and cost savings.

With Airwallex, businesses can take advantage of the following:

- No international transaction fee charged

- Lower currency conversion fees with access to market-leading FX rates that are up to 90% cheaper than the bank

- Payments can be domestic or international

- Receive your first $20k of conversions fee-free

- Instantly create virtual cards for yourself and your team to manage expenses

- Each subscription has its own virtual credit card so you can completely remove the card from being charged

- Manage all subscriptions in one place so you can keep track of what you have set up

- Access multi-currency accounts globally with local bank details

- Enable quick transfers to your suppliers and employees worldwide at interbank rates, regardless of the transaction size.

- Receive payments securely from your customers worldwide, through their preferred payment methods, without the need for coding.

- Open multi-currency accounts without visiting a bank branch and collect payments from customers in their preferred currency

- Automatically sync transactions to your Xero account

How to open a business account in Airwallex?

Applying for an Airwallex business account doesn't have to be complicated as it can be completed online. To set up an account, all you need is to provide the following information:

- Your name and business email address

- Company name and country where it is registered

- Valid mobile number

- Agreement to the terms and conditions

After submission, your application will be processed by Airwallex within 1 to 3 business days. During this period, the onboarding team may reach out to you via email to request additional information or any necessary business documents.

What are the requirements for opening an account with Airwallex?

If you are interested in opening an account with Airwallex, it is important to note that Airwallex only provides business accounts and does not offer personal accounts for individuals. In terms of eligibility, Airwallex accounts are limited to registered businesses in specific countries, operating in non-prohibited industries. Prohibited industries include arms dealing, gambling, pharmaceuticals, charities, and investment firms.

In addition, your business's country of registration will determine which Airwallex country is appropriate for your account application. For instance, if your business is registered in Hong Kong or one of the other countries supported by Airwallex (such as Mexico, Thailand, Taiwan, etc.), then you can only apply for a Hong Kong-based Airwallex account.

Businesses registered in this account will need to comply with Airwallex Hong Kong's terms and conditions, potentially influencing pricing, product availability, and the list of prohibited industries. Meanwhile, terms and conditions vary among corresponding countries.

Eligible countries include:

- Austria

- Australia

- Belgium

- Bulgaria

- Canada

- the Cayman Islands

- China

- Croatia

- Cyprus

- Czechia

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hong Kong SAR

- Hungary

- Iceland

- Ireland

- Israel

- Italy

- Korea, South

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Macau SAR

- Malaysia

- Malta

- the Marshall Islands

- Mexico

- the Netherlands

- New Zealand

- Norway

- Poland

- Portugal

- Puerto Rico

- Romania

- Seychelles

- Singapore

- Slovakia

- Slovenia

- Spain

- Sweden

- Switzerland

- Taiwan

- Thailand

- United Kingdom

- United States of America

- Virgin Islands (British)

- Virgin Islands (US)

What's the catch? Are there any hidden costs?

There are no setup or monthly fees with an Airwallex account. The only time you pay a fee is when you convert currencies (simply a 0.3% or 0.6% fee) or $15 to cover SWIFT payment fees.

Airwallex's fees are generally transparent. But you have to keep in mind that fees can differ based on the entity and location. To get updates, visit their pricing and fee schedule pages for the latest and most accurate information.

How can I transfer money overseas without fees?

Here are some ways to help you avoid paying a foreign transaction fee or a currency conversion fee when making purchases or paying for business tools in a foreign country.

- Choose and apply for a card that does not charge any fees.

- Determine if your bank is affiliated with a global ATM network that offers 'no fee' or 'low-cost' withdrawals.

- Sign up for a currency exchange rate app like Airwallex that does not charge any fees for international transfers, all while staying informed about the current market exchange rates at any given time.

How to issue card payments without any international transaction fee?

Credit cards often make international transactions easy. However, they may come with foreign transaction fees if you're not careful. To avoid these fees, taking time to read the fine print is key. But if the fees are too high, you might want to consider switching to a new credit card provider instead.

Airwallex Borderless Cards are a clever way to steer clear of foreign transaction fees on card payments. With Airwallex, you can issue and manage virtual cards in multiple currencies without any monthly or annual fees. Ultimately, you won't have to worry about any international transaction fee, only a minimal FX margin of either 0.3% or 0.6% applies.

How can I buy supplies from overseas without any foreign transaction fee?

While you can't avoid purchasing supplies overseas, there are ways to minimise foreign transaction fees and make the overall process more cost-effective.

You have the option to make payments to the supplier in their local currency using a direct bank transfer to avoid the SWIFT network and any additional bank fees. Furthermore, take the time to double-check your chosen payment method before making any payments or purchases. These methods typically incur fees as a percentage, which means your costs will increase relative to the size of your transactions.

Takeaway

If you are a business owner looking for ways how to avoid foreign transaction fees, it is highly recommended that you choose a bank account that does not impose any charges or use a credit card or a debit card that doesn't charge foreign transaction fees. If possible, consider negotiating with your bank or credit card company to have foreign transaction fees waived for a period of time. But if these options aren't working for you, you might want to use a foreign exchange provider such as Airwallex that allows you to transfer funds internationally without incurring high fees.

With Airwallex, you don't have to worry about paying for any charges. Their Borderless Card payment solutions come with no foreign transaction fees and no monthly fee charges, making it a cost-free option for your everyday transactions. In addition, Airwallex Foreign Currency Accounts allows you to maintain a business account in a foreign currency, where you can send and receive funds in your preferred currency without the need for traditional banks. Indeed, Airwallex offers the best solution to make payments faster, easier and more cost-effective.

Schedule a demo today and discover how your business can eliminate foreign transaction fees.

Love My Online Marketing has 10+ Years of working alongside businesses and helping them grow. Discuss your options for online success from website Design and Development through to Google Marketing.

Do you want more traffic and business leads?

Love My Online Marketing is determined to make a business grow. Our only question is, will it be yours?